The Path Ahead

Looking at the positive projections for the pellet industry, the

domestic pellet industry is understandably cautious. After all, the last

boom cycle in pellet expansion was followed by price-depressing excess

capacity. But with the industrial export market booming, and the

potential for the export fever to spread to premium heating pellets,

domestic producers are keeping their eyes on the path ahead.

Jennifer

Hedrick, executive director of the Pellet Fuels Institute, cited

promising statistics in her opening remarks at the PFI conference in

Orlando in late July. “Supply and demand are starting to realign and

promotion of home boiler systems is starting to expand demand,” she

said. Capacity utilization plummeted from nearly 90 percent in 2007 to

around 55 percent in 2009 due to price-depressing over expansion, she

explained. Capacity utilization has since slowly rebuilt, with

projections indicating it should reach 80 percent by 2018. North

American wood pellet production is forecast to grow 14 percent annually

over the next five years from 7.9 million tons in 2013 to 15.5 million

tons in 2018, she continued. Exports are expected to increase from 4.5

million metric tons (mmt) in 2013 to 10.5 mmt in 2018, primarily coming

from the U.S. South and Canada. Growth is expected to be a much more

modest 5.8 percent per year in other regions that primarily supply the

residential heating market, the U.S. Northeast, Pacific Northwest and

Lake States.

Manufacturer’s View

While

Hedrick painted a somewhat cautious picture for domestic pellet

producers in the long run, the panel of appliance manufacturers and

distributors were bullish on this year’s outlook. “This year has taken

off,” said John Shimek, with manufacturer Hearth & Home Technologies

Inc. The marketing campaign to buy early and buy now is working, he

explained, and consumers are buying pellet appliances. “We’re doing

everything we can to keep up.”

When asked about the relative

expense of pellet appliances in the panel discussion, Shimek replied

that both low- and high-end appliances, ranging from $3,000 to $5,000,

were selling equally well. Dutch Dresser, with Maine Energy Systems,

admitted his company’s whole-home pellet boiler systems were “the most

expensive in the room” at around $20,000, but added, “We do pretty well.

Our growth has been hockey-stick shaped.”

In his company’s work

to promote boiler systems using pellets delivered in bulk, Dresser

added that he’s seeing a need to change the consumer message. With more

appliance options entering the market, the messages informing people

about the advantages of pellet heating need to expand to educating

consumers to buy the appropriate quality system. He suggested

introducing a new metric: “How long do you want your boiler to run

unattended reliably?” If a boiler needs to be cleaned every three days,

for instance, and the homeowner is often gone, that may not be the best

choice. A higher-priced, more automated system might meet the consumers’

needs better.

Improving the ease of use for consumers is the big

thing coming to the pellet appliance sector, said several speakers in

the panel. Carroll Hudson, England’s Stove Works Inc., said his

company expects to have new control systems on the market later this

year that can be operated from a smart phone. “The ease of use in pellet

appliances has helped expand the market on all sides,” concurred Jeff

Thiessen, speaking on the panel from Dansons Inc., manufacturers of wood

pellet Louisiana Grills. Dresser added the European manufacturer of the

boilers distributed by MES already has a smart-phone app that will even

recognize how far from home you are and turn up the thermostat so the

house is warm when you arrive home. The app is now being translated from

German. At Hearth & Home Technologies, Shimek said the company is

introducing smart controls that can be adjusted to the homeowner’s

preferred level of complexity. “We can also track use and send back

diagnostic code to your dealer so when they come out to do service, they

bring the right parts,” he added.

Marketing Insights

Ease

of use is an important value for consumers that is being missed in

consumer messaging said another conference speaker, Adee Athiyaman,

professor of marketing at Western Illinois University. In his

survey-based analysis of consumer behavior and attitudes regarding

biomass heating products, he has identified several values considered

most important, including cost, safety and ease of use. He then analyzed

industry advertising to see which attributes are mentioned, finding

that quality is most frequently mentioned in pellet appliance

advertisements, followed by price and special offers, availability,

safety and warranties, in that order. There is a big gap, he said. “The

ads do not emphasize the ease of use of the product, which is a major

concern for the consumers.” He encouraged conference attendees to

prompt people to fill out the online survey, available at www.instituteintelligence.com.

The Case For Pellets

William

Strauss, FutureMetrics LLC, presented a summary of his ongoing analysis

of the North American pellet market, describing the potential for

market expansion. Strauss estimated there are about 4.4 million homes

across northern tier states that could potentially convert to pellet

wood heating, being both in cold climates with large areas not on

natural gas. “Growing that market takes patience and a lot of work,” he

admitted. From his analysis of appliance sales data, Strauss is

projecting 67 percent growth in pellet demand for domestic heating,

growing from 3.3 million to 5.5 million tons between 2013 and 2020. The

expected 5.5 million tons is in the middle of a band with 95 percent

confidence that could be as high as almost 7 million tons, or as low as

nearly 4.5 million tons. “I don’t think natural gas will stay super

cheap,” he added, “Natural gas will soon be bidding on global markets.”

While

the export demand projections for industrial pellets is well-known,

Strauss addressed the potential for export demand in residential heating

pellets. He pointed out that in just four European countries—Germany,

Italy, Austria and France—projections indicate that by 2017 there will

be a 6 million metric ton gap between domestic production and demand.

Currently, nearly all of the U.S. industrial pellet exports are

originating in the South and heading for the United Kingdom.

While

the industry is expecting an increase in demand for power generation in

Europe and new markets opening up in South Korea, Strauss made a case

for the strong potential for market growth in the U.S. power generation

sector. “About 77 percent of coal plants in the U.S. are older than 35

years,” he pointed out. “These are only pulverized coal plants, not

stoker. It’s pretty easy to pulverize pellets and use them in pulverized

coal plants.” The main cost for retrofits is in storage and pellet

handling, he added, estimating the conversion of pulverized coal to

pellets is nearly the same as natural gas conversion. When looking at

alternatives such as wind, solar or hydro, the fuel may be free, but the

capital expenditure is high. In contrast, most of the 35-year-old

coal-fired power plants are paid for. “I think it makes really good

sense for old power plants to convert,” he said.

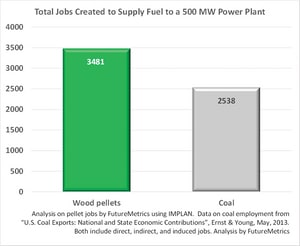

On top of that

is the potential for job creation, he said. The total jobs created to

supply pellet fuel to a 500 MW power plant would number 3,481, according

to his analysis, compared to the 2,538 jobs created by coal that was

estimated in a 2013 Ernst & Young analysis. “We have a job-creating

solution here for low-cost, low-carbon, baseload, dispatchable power,”

he said.

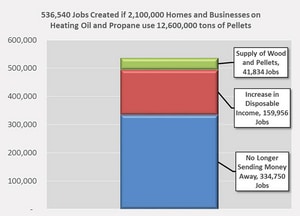

That economic impact would be multiplied if accompanied

by a conversion of half of the 4.2 million homes in northern tier states

that are candidates for pellet heat. “There’d be 500,000 jobs created

for the 2.1 million homes. And, if they cut heating costs in half, they

can spend that money on other things. Plus when spending money on

heating, a big portion goes to other countries,” Strauss added. “With

pellets, we keep that money in the U.S.”

While the potential is

there, Strauss cautioned that the critical questions will be how much

sustainable pellet quality wood is available and what will be the

highest, best use—heating, power or export? “Will it be power at 35

percent efficiency, or heating at 85 percent efficiency?” he asked. In

the discussion following his presentation, he added that initial studies

done by power plants looked at converting pulverized coal plants to

stoker plants using wood chips—a more costly option than pulverizing

wood pellets. The Drax conversions in the United Kingdom are serving as a

proof of concept, he added. “It’s showing it can be done. I think

[power companies] will take another look, I think there is real

opportunity.”